For full-year fiscal 2017 (to end-April), fiber-optic communications component and subsystem maker Finisar Corp of Sunnyvale, CA, USA has reported record revenue of $1449.3m, up 14.7% on fiscal 2016’s $1263.2m.

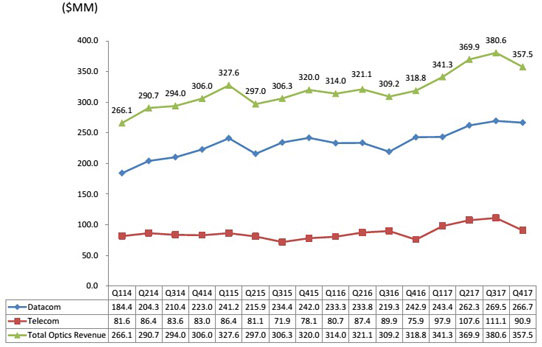

However, for fiscal fourth-quarter 2017 revenue was $357.5m, up 12% on $318.8m a year ago but down 6.1% on $380.6m last quarter (and lower than even the reduced guidance of $360-380m).

Telecom product sales were $90.9m, up 19.8% on $75.9m a year ago but down 18.2% from $111.1m last quarter (exceeding the expected drop of just $15m), due mainly to a decline in revenue from Chinese OEM customers (historically about 20% of total revenue, but currently in the low teens) plus the impact of the full three months of the annual telecom price erosion.

Datacom product sales were $266.7m, up 9.8% on $242.9m a year ago but down 1.1% on $269.5m last quarter (contrary to the expected growth of $5m). Sales of 100G QSFP28 transceivers for datacom applications continued to rise strongly (by over 30%), but this was more than offset by lower demand for other datacom products, primarily 10G-and-below shortwave transceivers (which comprise about 20% of datacom revenue, and are expected to continue to decline).

There was just one 10%-or-greater customer (rather than two last quarter). The top 10 customers comprised 58.9% of total revenue (up from 57.4%).

On a non-GAAP basis, full-year gross margin has risen from 30.3% in 2016 to 35.9% in 2017. However, although up on 30.6% a year ago, fiscal Q4 gross margin was 36.2%, down from 37% last quarter (due mainly to the impact of the full three months of the annual telecom price erosion).

Operating expenses have risen further, from $66.2m a year ago and $70.5m last quarter to $71m (exceeding the expected $70m). Full-year operating expenses hence grew from $269.9m in 2016 to $280.3m in 2017 (although falling from 21.4% of revenue to 19.3% of revenue).

Full-year operating income has more than doubled from $112.3m (operating margin of 8.9% of revenue) in 2016 to $240.6m (16.6% margin) in 2017. However, up on $31.2m (9.8% margin) a year ago, fiscal Q4 operating income was $58.4m (16.3% margin, rather than the expected 17%), down from $70.4m (18.5% margin) last quarter.

Full-year net income has similarly more than doubled from $109.8m ($1.01 per fully diluted share) in 2016 to $231.7m ($2.03 per fully diluted share) in 2017. However, up on $31.8m ($0.29 per fully diluted share) a year ago, fiscal Q4 net income was $57.5m ($0.50 per fully diluted share, at the bottom of the guidance range of $0.50-0.56), down from $67.2m ($0.59 per fully diluted share) last quarter, due to mainly the lower revenue.

Capital expenditure (CapEx) was $47.8m. Finisar recently started construction of a third building on its Wuxi site (to be completed in calendar second-half 2018), primarily for manufacturing.

Cash, cash equivalents and short-term investments have risen by $22.6m during the quarter and by $674.3m over the full fiscal year to $1.237bn (up from $562.5m), due mainly to the issuance in December of $575m of 0.5% convertible notes due in December 2036, which yielded net proceeds of $569.3m. Excluding those net proceeds, cash would have risen by $105m over the year.

For fiscal first-quarter 2018 (to end-July 2017), Finisar expects revenue to fall to $330-350m, due mostly to lower telecom revenue at Chinese OEM customers. “Datacom will be relatively flat as revenue growth for 400G QSFP28 transceivers is offset by lower sales of 10G and 100G CFP2 Ethernet transceivers,” says chairman & CEO Jerry Rawls. Due mainly to lower revenue, gross margin should fall to 35%. OpEx should be relatively flat at about $71m. Operating margin is expected to fall to 14%. Earnings per fully diluted share is expected to fall to $0.37-0.43. CapEx is projected to be about $45m (then in the same range in fiscal Q2, before starting to trend down by about $5m per quarter).

“Despite a challenging outlook in the near-term with lower demand for our Chinese OEM customers, we are optimistic about the outlook for Finisar’s fiscal 2018,” says Rawls. Revenue growth is expected to resume in fiscal Q2 (to end-October), driven by sales growth in 100G QSFP28 transceivers for hyperscale data centers and sales of vertical-cavity surface-emitting laser (VCSEL) arrays for 3D sensing. “We have made really good progress on our high-powered VCSEL array program,” notes Rawls. “We have received production purchase orders and expect to soon receive customer approval to ship meaningful volumes [tens of millions] in our second fiscal quarter.” In addition, the 100G & 200G coherent CFP2 ACO transceivers and reconfigurable optical add-drop multiplexer (ROADM) line-card should be fully qualified by a key OEM customer that is supplying to the Verizon Metro upgrade. “We are currently qualified at multiple other customers for our CFP2 ACO and are in the qualification process with a number of additional new customers,” notes Rawls.